Doing business internationally certainly involves additional risk. Every exporter should be aware of the different types of risks and be able to analyze and minimize them as much as possible. Finally, knowing the pros and cons of the different types of payment methods allows an exporter to make an informed decision on the preferred method of payment.

Determining the type of payment may be outlined in your contract if it is an ongoing relationship with an international partner. See the section on contracts. The following types of payments are also applicable for single sales.

I want to read about it

For a comprehensive guide to Trade Finance, read through this quick reference for exporters provided by the U.S. Department of Commerce’s International Trade Administration.

What is the Trade Finance Guide?

The Trade Finance Guide covers the most commonly used trade finance techniques and U.S. government export finance programs written in plain, easy-to-understand language. The guide is:

- A 60-minute self-learning tool for America’s new-to-export SMEs that wish to learn about their financing options and how to ensure getting paid from export sales.

- A user-friendly counseling tool for international credit, banking and trade finance professionals and export counselors for client assistance and business development.

- A flexible educational tool for academic institutions teaching international business subjects.

The guide uses a no-nonsense approach to make it easier for new-to-export SMEs to learn the basics of trade finance and to understand how to mitigate the risk of non-payment while winning new cross-border sales opportunities and assuring the delivery of goods and services to importers.

Types of Payments

Cash in Advance

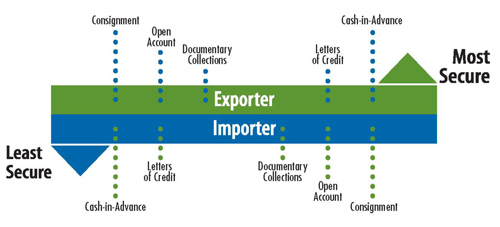

Payment in full is received before goods are shipped. This is the most secure type of payment for exporters, but it is the least secure and least attractive for the buyer. Although common, this can cause exporters to lose potential market share to other exporters who offer better terms for the buyer. However, this is a common option for first-time purchases before a relationship is established, when a country is politically risky or with an internet-based business where using upfront credit card payments is common.

Letters of Credit

This is one of the most secure tools for international exports. A letter of credit is a commitment by a bank on the behalf of the buyer that payment will be made if the terms and conditions of the LC are met. A buyer pays their bank for this service and pays the exporter when the goods are shipped, not necessarily when they're received. This is useful when credit information about the buyer is hard to obtain, but the exporter trusts the buyer's bank. It is also useful when dealing with countries that are politically unstable. The bank as an independent third party and makes sure the seller will get paid by using what is similar to an escrow account. LCs can also be used in the reverse, so the buyer is protected to make sure the exporter delivers their product. This method requires a fee but helps to reduce risk for the exporter. LCs can be easily used for single transactions and are good options for the first transaction between two parties.

Documentary Collection

These are similar to letters of credit but involve a little more risk to the exporter and are less expensive and less complicated. The exporter and importer's banks act as intermediaries between the two parties. Importers generally are not required to pay for the goods before shipment and do not obtain the title for the goods until they are received. This method can be used after a relationship is established between the two parties and there is a degree of trust between them. Importers may also prefer to use this method as there is less cost and less risk for them compared to a letter of credit.

Open Account

An open account transaction is a sale where the goods are shipped and delivered before payment is due, which is usually in 30-90 days. This option is the most advantageous to the importer but the highest risk for the exporter. Global competition for sales of certain goods can give buyers the advantage, and exporters may lose sales if they don’t offer this sales term.

programs and techniques to help exporters offer Open Account payment

Export Credit Insurance

Export credit insurance protects an exporter of products and services against the risk of non-payment by a foreign buyer. EXIM Bank offers some of the best rates and coverage.

Contact EXIM's regional director for Montana for more information.

Mitsu Saito

206-738-7955

mitsutaka.saito@exim.gov

What is export credit insurance?

What is a working capital loan guarantee?

Finance a foreign buyers purchase.

Export Working Capital Financing

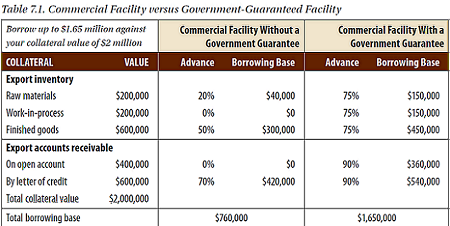

EWC financing helps exporters purchase goods and services if they lack the cash on hand necessary to do their business, such as materials, labor and inventory. These loans are through private banks. Government guarantees can be sought through the U.S. Small Business Association's loan program or EXIM Bank to help facilitate these loans.

Government-Guaranteed Export Working Capital Programs

Small or new business may not be able to get private bank loans. The SBA and the EXIM Bank offer loan guarantees to participating lenders for making export loans to U.S. businesses. Visit the SBA loan page of the EXIM Bank loan page for more information.

Export Factoring

Export factoring is a financial package that combines export working capital financing, credit protection, foreign accounts receivable bookkeeping and collection services. Export factoring is an agreement between the bank and exporter in which the bank purchases the exporter’s short-term foreign accounts receivable for cash at a discount from the face value. The bank assumes the risk of collection from the buyer, allowing the exporter to offer open accounts, improving liquidity and boosting competitiveness in the global marketplace.

Types of Risk to Consider

Commercial Risk

Match payment terms with identified risk. The higher the risk, the greater the use of secured terms. There is no credit risk associated with a transaction if no credit is extended. For example, if the payment terms are cash in advance or a credit card is used, the invoice is paid prior to shipping and no risk is created.

Political Risk

Political risk is the inability of your customer to pay the receivable in full and on time due to government action. The level political risk is generally associated with the political stability and outlook of the government of the foreign buyer. Examples include the risk of war, government actions or significant economic shocks that could affect exporters such as a delay of payment. Assessing political risk should be done through research on the government and political environment of the foreign buyer. There are only two ways to minimize political risk. If the risk is high, the payment method should be adjusted accordingly. Usually, prepayment is the best way to avoid political risk. If prepayment is not acceptable, a second option is export credit insurance. For example, EXIM Bank offers programs other than its small business policy that can be applied to a specific transaction.

Foreign Exchange Risk

Foreign exchange risk is defined as a change in the foreign exchange rate from the time the sales price is established and accepted to when payment is made. Whenever the exchange rate changes, it impacts either the seller or the buyer. The company’s international strategy must be flexible enough to deal with long-term foreign exchange movement. Companies can diversify sales markets and potential through sourcing and manufacturing locations.

I want to watch a video about it

More information

If you have further questions related to payment and finance, please reach out.